All Categories

Featured

Play the waiting video game until the residential property has actually been foreclosed by the area and sold and the tax obligation sale.

Pursuing excess profits provides some pros and cons as an organization. Consider these before you include this method to your actual estate investing repertoire.

There is the possibility that you will certainly earn nothing in the end. You might lose not only your money (which ideally will not be really much), yet you'll likewise lose your time as well (which, in my mind, deserves a great deal extra). Waiting to collect on tax obligation sale overages calls for a great deal of resting, waiting, and hoping for results that generally have a 50/50 chance (usually) of panning out positively.

Collecting excess proceeds isn't something you can do in all 50 states. If you have actually currently got a building that you desire to "roll the dice" on with this strategy, you would certainly much better hope it's not in the incorrect component of the nation. I'll be honestI have not invested a great deal of time messing around in this area of investing due to the fact that I can not manage the mind-numbingly slow-moving rate and the total lack of control over the process.

In addition, a lot of states have regulations impacting proposals that go beyond the opening bid. Repayments above the region's standard are known as tax obligation sale overages and can be lucrative investments. The details on excess can produce problems if you aren't conscious of them.

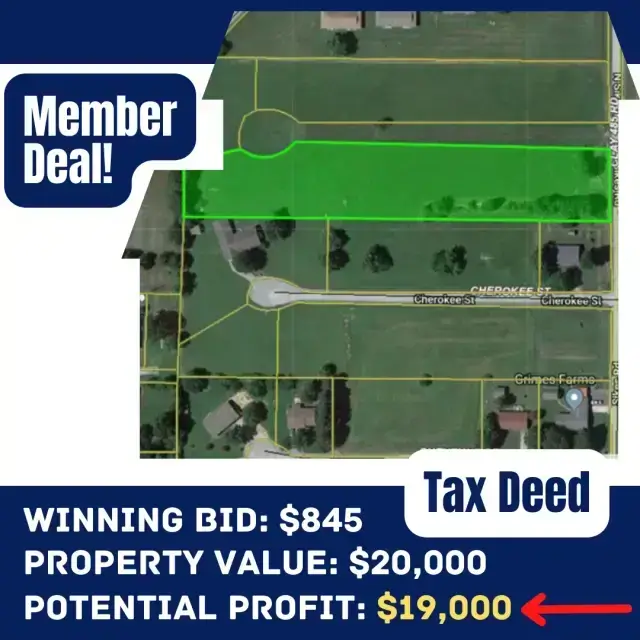

In this post we inform you just how to obtain lists of tax overages and earn money on these possessions. Tax obligation sale excess, likewise known as excess funds or exceptional bids, are the quantities proposal over the starting price at a tax public auction. The term describes the dollars the investor invests when bidding over the opening proposal.

The $40,000 boost over the initial proposal is the tax obligation sale overage. Declaring tax sale excess suggests getting the excess money paid throughout an auction.

That said, tax sale overage cases have actually shared characteristics across a lot of states. During this period, previous owners and mortgage holders can contact the region and receive the excess.

If the duration runs out before any kind of interested events declare the tax obligation sale overage, the area or state usually takes in the funds. Previous owners are on a stringent timeline to case excess on their residential properties.

Lien Properties

Keep in mind, your state regulations impact tax obligation sale excess, so your state might not allow investors to collect overage rate of interest, such as Colorado. However, in states like Texas and Georgia, you'll earn interest on your whole quote. While this element doesn't mean you can declare the excess, it does assist minimize your costs when you bid high.

Remember, it may not be legal in your state, meaning you're restricted to collecting rate of interest on the excess. As stated above, a financier can find ways to benefit from tax obligation sale excess. Due to the fact that rate of interest income can relate to your entire proposal and past owners can declare overages, you can leverage your expertise and devices in these situations to make best use of returns.

An essential aspect to keep in mind with tax obligation sale overages is that in a lot of states, you just need to pay the area 20% of your complete quote up front., have regulations that go past this policy, so once more, research study your state regulations.

Rather, you only need 20% of the proposal. If the home doesn't retrieve at the end of the redemption period, you'll need the remaining 80% to obtain the tax obligation action. Since you pay 20% of your bid, you can make interest on an overage without paying the full cost.

Once more, if it's legal in your state and county, you can function with them to aid them recover overage funds for an extra cost. You can collect interest on an overage quote and bill a fee to simplify the overage insurance claim procedure for the past proprietor.

Overage enthusiasts can filter by state, region, property kind, minimum overage quantity, and optimum excess amount. Once the data has actually been filtered the collectors can determine if they intend to add the miss mapped information plan to their leads, and after that spend for only the verified leads that were found.

Tax Property Sale

To begin with this game transforming product, you can learn much more here. The finest way to obtain tax sale overage leads Concentrating on tax sale overages rather of traditional tax obligation lien and tax obligation action investing needs a specific method. Additionally, simply like any various other financial investment technique, it provides one-of-a-kind benefits and drawbacks.

Otherwise, you'll be prone to unseen dangers and lawful implications. Tax obligation sale excess can form the basis of your financial investment design due to the fact that they provide an inexpensive way to make money. As an example, you do not have to bid on residential or commercial properties at auction to buy tax obligation sale overages. Rather, you can investigate existing overages and the previous proprietors who have a right to the cash.

Rather, your study, which might entail miss tracing, would set you back a relatively tiny fee.

Your sources and technique will certainly figure out the most effective environment for tax overage investing. That claimed, one method to take is collecting passion above costs. To that end, capitalists can purchase tax sale overages in Florida, Georgia - back taxes owed on homes, and Texas to make use of the costs quote legislations in those states.

Any kind of auction or foreclosure entailing excess funds is a financial investment possibility. You can invest hours investigating the past proprietor of a building with excess funds and call them only to find that they aren't interested in seeking the cash.

Latest Posts

Tax Delinquent Properties Sale

How To Find Tax Foreclosure Properties

Government Property Tax Auctions